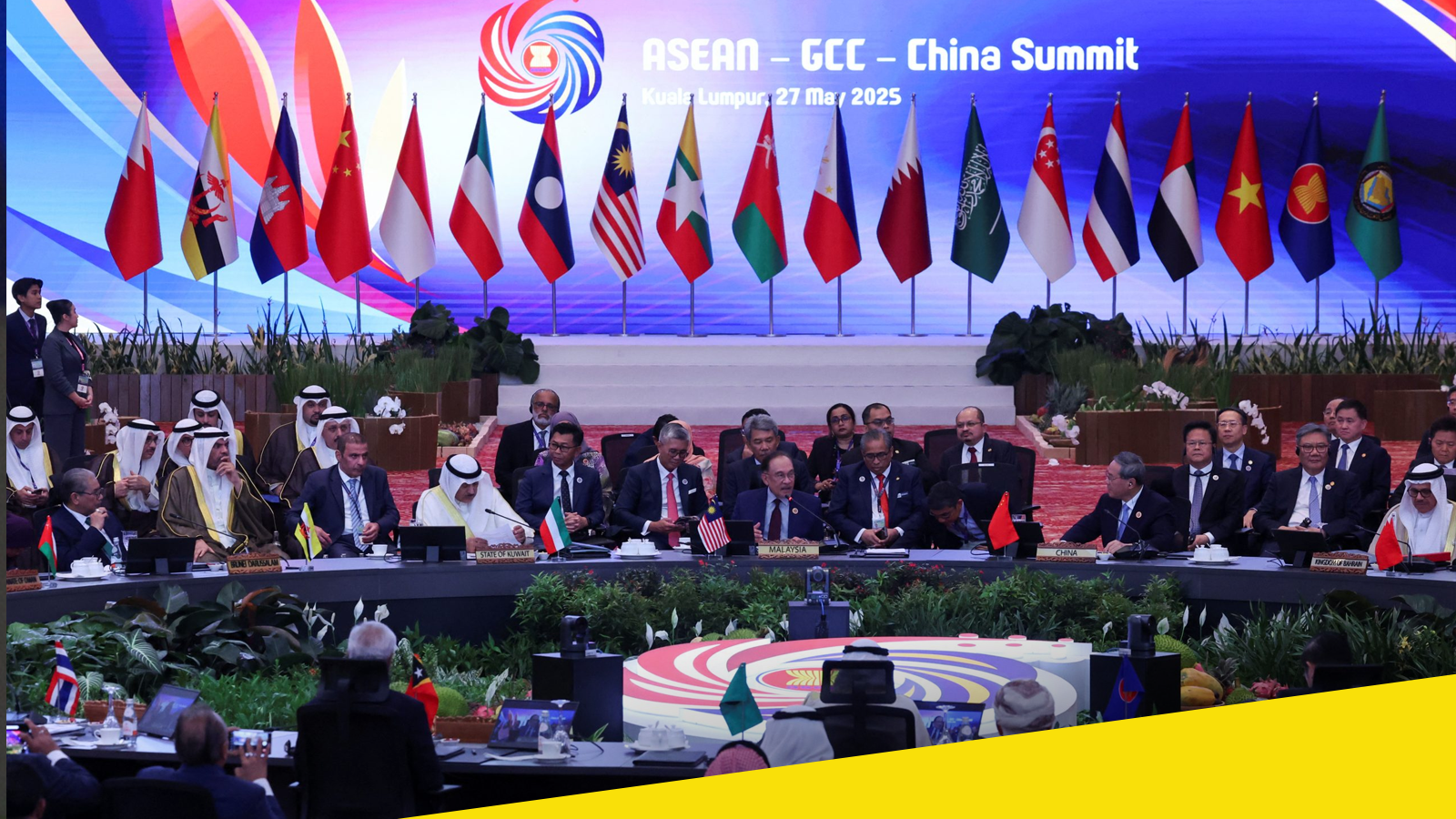

Gulf government and corporate bonds are witnessing a significant surge in demand from Asian investors, driven by strong economic performance, stable fiscal policies, and expanding financial cooperation between the GCC, ASEAN nations, and China. The momentum was further highlighted during the high-level ASEAN–GCC–China Summit held in Kuala Lumpur on 27 May 2025, where economic integration and cross-border investment took center stage.

Financial analysts report that the UAE, Saudi Arabia, and Qatar are experiencing particularly strong inflows, as investors across Asia seek safe, stable, and high-yield opportunities amid global economic uncertainty. Gulf bonds—traditionally attractive for their solid credit ratings and predictable returns—have become even more appealing as the region accelerates diversification efforts beyond oil, boosts infrastructure spending, and strengthens ties with Asian markets.

The summit emphasized long-term financial cooperation, with leaders discussing mechanisms to streamline bond market access, promote dual listings, and create more efficient regulatory frameworks. China and several ASEAN countries expressed interest in expanding sovereign wealth fund partnerships, co-investing in green energy projects, and increasing participation in Gulf debt issuances.

Experts note that the UAE stands out as a top destination due to its robust financial sector, transparent regulatory environment, and growing reputation as a global investment hub. Asian institutional buyers, including pension funds and asset managers, are increasingly diversifying their portfolios with Gulf fixed-income products.

As geopolitical tensions and market volatility persist worldwide, the growing Gulf–Asia financing corridor is expected to further strengthen, positioning the region as a major player in the global bond market for years to come.